Overview

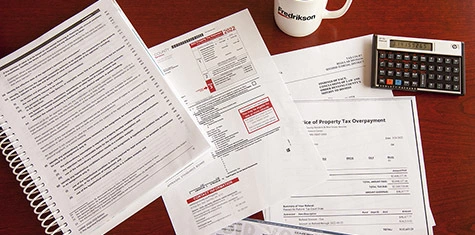

Tax comprises several practice groups that counsel clients on all facets of business and tax planning as well as tax controversies and litigation. Our tax and business planning attorneys assist our clients – including closely held and family-owned businesses as well as public companies – throughout the processes of business formation, operation and succession, with the view to providing efficient U.S. federal, international, and state and local tax solutions at every stage of a business lifecycle. We help tax-exempt entities and nonprofit corporations with tax planning, governance and management challenges, donation planning, employment issues, and director and officer responsibility and liability matters.

Our tax controversy attorneys represent a wide range of clients at all levels of tax controversies, including voluntary disclosures, audits, administrative appeals, conferences and hearings, criminal tax investigations and tax litigation in state and federal courts. Throughout our representation, we strive to obtain fair and thoughtful review of the dispute to achieve the best possible result for our client at the earliest opportunity.

Related Services

Team

Main Contacts

- 612.492.7035

- 612.492.7020

- 612.492.7410

Show all Tax professionals

- Danyal Ahmed

- Kari Alstad

- Eric S. Anderson

- Thomas B. Archbold

- Thomas L. Bird

- Kyle M. Brehm

- Judy S. Engel

- Samuel D. Gilbaugh

- Dominick J. Grande

- Mark W. Greiner

- Laura A. Habein

- Thomas B. Henke

- William M. Howieson

- Michael P. Jacobs

- Sean P. Kearney

- Kenneth S. Levinson

- Debra J. Linder

- Lynn S. Linné

- Travis J. Logghe

- Warren E. Mack

- Daniel C. Mott

- Sue Ann Nelson

- Sage H. O'Neil

- Robert M. Oberlies

- Mark D. Salsbury

- Gauri S. Samant

- Dylan B. Saul

- Erik A. Splett

- David B. Tibbals

- Sarah E. Tucher

- Laura J. Wanger

- Allison O. Woodbury

News & Insights

Firm NewsBusiness & Tax Planning Attorney Samuel Gilbaugh and Energy & Natural Resources Attorney MaKennah Little Join Fredrikson

Firm NewsBusiness & Tax Planning Attorney Samuel Gilbaugh and Energy & Natural Resources Attorney MaKennah Little Join Fredrikson- Legal Blog‘New Elective Safe Harbor’ Is Not for Everyone: Recent Guidance on the Inflation Reduction Act’s Domestic Content Bonus

- Legal UpdateSupreme Court Alters Regulatory Environment for Business: the Loper Bright (Chevron), Corner Post and Jarkesy Decisions