Overview

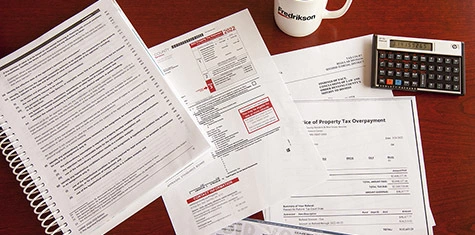

Laura litigates income tax controversies at the state level and pursues tax refunds and future tax reductions for her property tax clients.

Laura is an attorney in Fredrikson’s Property Tax Appeals Group. She focuses on controversies at the state and local level, including property tax and income issues.

In her property tax appeals practice, Laura has experience in commercial property valuation and equalization issues, with a focus on department stores, single-user retail, multi-tenant shopping centers and multi-family apartment buildings. Laura pursues both tax refunds and future tax reductions for her clients.

In her income tax practice, Laura has experience in handling residency audits and appeals, independent contractor taxation and personal liability assessments.

On a pro bono basis, she assisted two charitable organizations in forming as non-profit corporations and obtaining 501(c)(3) federal tax exempt status.

Laura serves clients from a variety of industries including cooperatives, energy, health care, courier and delivery services, department store, shopping centers, and private charities.

Services

Experience

- Assisted Florida resident (former Minnesota resident) in appealing assessment of Minnesota state income tax (after move to Florida).

- Assisted Minnesota cooperative in appealing sales tax assessment.

- Assisted Minnesota retailer in lowering its property tax bill.

Credentials

Education

- William Mitchell College of Law, J.D., 2010, summa cum laude

- University of Minnesota, B.A., 1996

Admissions

- Minnesota, 2010

- U.S. District Court for the District of Minnesota, 2010

Recognition

- North Star Lawyer, Minnesota State Bar Association, 2012, 2014

- 4 CALI Awards of Excellence

Civic & Professional

Professional Activities

- Minnesota Bar Association

- Hennepin County Bar Association

- National Association of Industrial and Office Properties

- Minnesota Shopping Center Association

- Institute for Professionals in Taxation

- International Council of Shopping Centers, Inc.

- William Mitchell Law Review, 2008-2010

Community

- Inver Grove Heights BEST Foundation, Former Board Member, 2013-2014