Overview

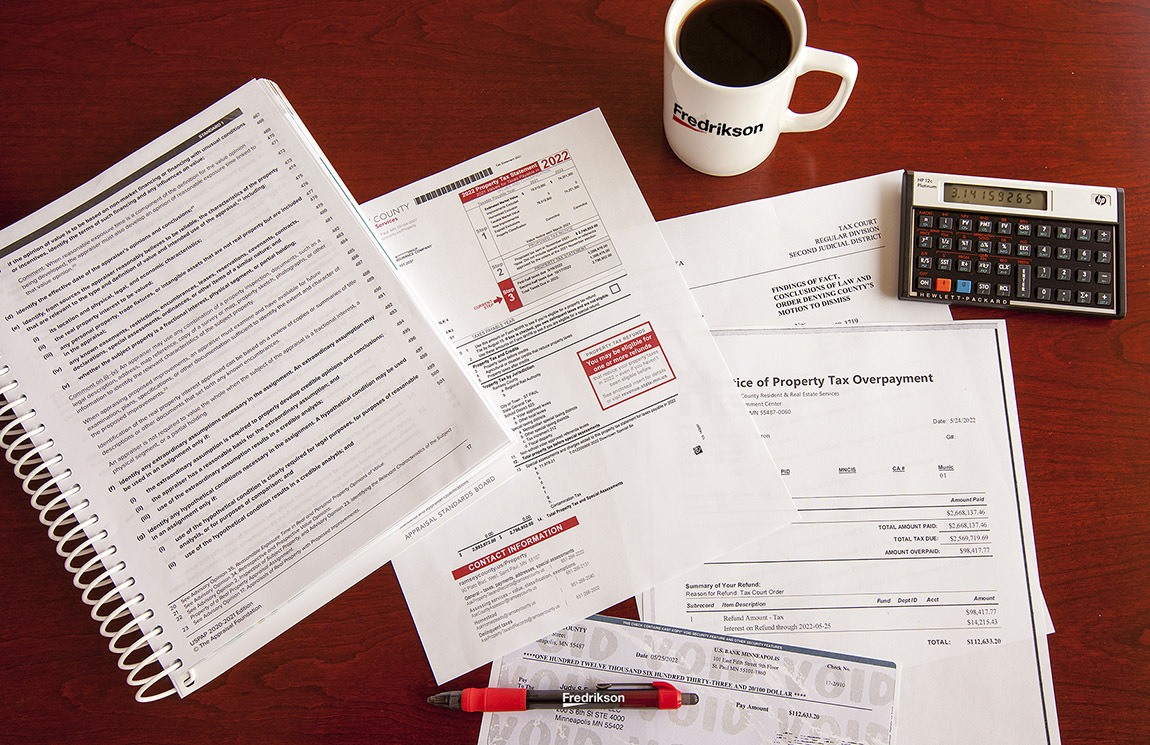

We represent many all kinds of commercial property owners, developers and managers, and have obtained reductions in real estate taxes in excess of many millions of dollars each year for our clients.

We will review your assessor’s market value and provide an initial preliminary analysis at no cost or obligation. If you decide to challenge the assessor’s estimated market value, we will then pursue your reduction through negotiation and trial. We have successfully handled cases on a variety of fee arrangements: contingent (percentage) fee arrangements, regular hourly rates, and combinations of the two.

Our highly qualified team includes experienced attorneys and professionals who together bring more than 100 years of experience in valuation-based litigation and property tax appeals. We are also backed by the support of the broad knowledge and experience of the firm’s full-service Litigation and Real Estate & Construction groups.

Related Services

Experience

Department Stores & Shopping Centers

Our representation of many big box retailers, national retailers and major shopping center developers and managers has led to reductions in real estate taxes in excess of several million dollars each year for major retail facilities.

Hotels & Motels

We have extensive experience with the complexities of hoteland motel properties, and have achieved reductions as high as 45% or in excess of $500,000 per year in taxes.

Office Buildings

We have generated real estate tax savings as high as seven figure amounts for our clients, reducing the taxable value by as much as 70% for properties in both the Minneapolis and St. Paul central business districts and in the greater metro area.

Environmentally Contaminated Properties

We are nationally recognized for our cutting-edge work in cases where the market value of the subject property is adversely affected by petroleum derivatives, asbestos, polychlorinated biphenyls (PCBs), landfills, and other contaminants.

Medical Office Buildings

We have developed considerable expertise in the valuation of medical office buildings resulting in substantial reductions for our clients.

Industrial & Manufacturing Properties

We have regular experience with single- and multi-tenant industrial properties, and have achieved tax reductions for our clients reducing the estimated market value by millions of dollars, including newer facilities.

Office Warehouse & Office Showroom Facilities

We have achieved value reductions in excess of $3 million per year.

Development Sites

We have achieved tax reductions of more than 50% on unimproved parcels.

Apartment Buildings

Even in a rising market we achieved annual reductions in market value of several million dollars on both market-rate and subsidized apartment complexes, in some instances reducing taxes by more than 50%.

Grain Elevators

We have achieved reductions in appeals of grain elevators exceeding 30%.

Bank Properties

We have successfully represented several major banks in trial and in negotiations.

Restaurants

We have extensive experience with restaurant properties and have achieved reductions of 20% to 40%.

Exemptions

We have significant expertise in obtaining full and partial real estate tax exemptions for our clients under various Minnesota constitutional and statutory provisions.

Team

Main Contact

- 612.492.7118