Donatelle Plastics Incorporated (Donatelle), a pioneer in medical device design, development and contract manufacturing, turned to Fredrikson for guidance through every stage of its sale to the chemical giant DuPont.

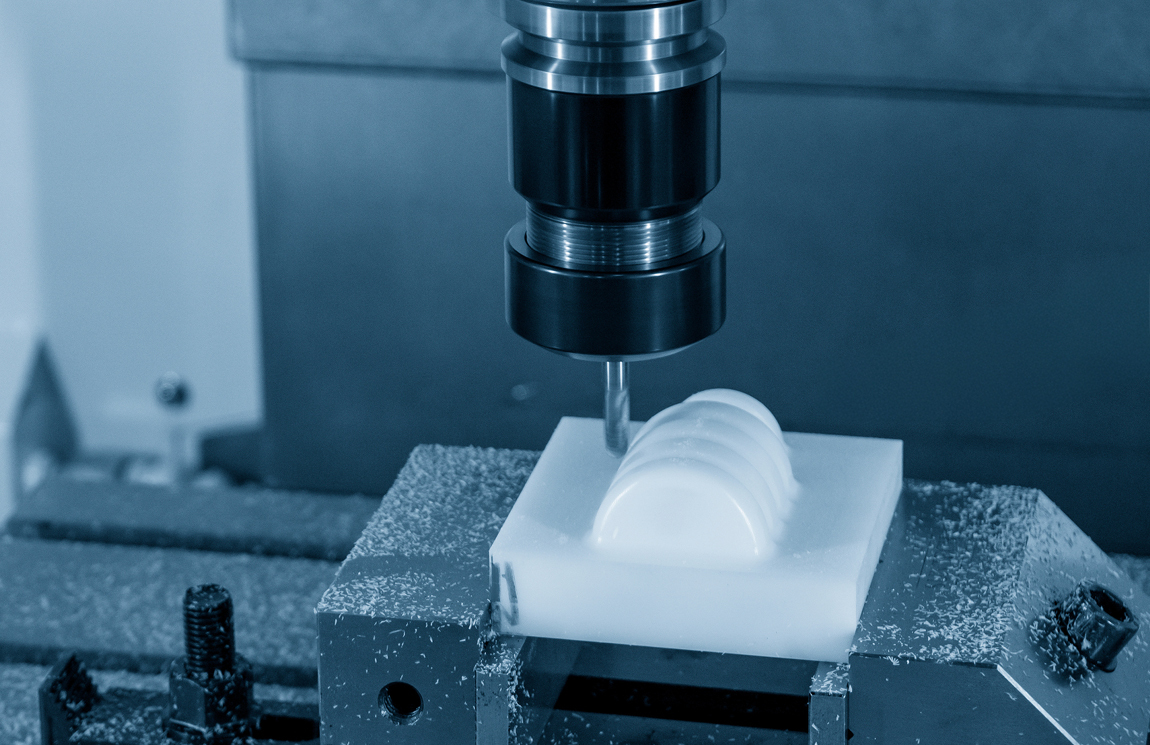

Founded in 1967, Donatelle Plastics Incorporated (Donatelle) had over the years acquired a reputation as a pioneer in medical device design, development and contract manufacturing. But change was coming, in the form of the chemical giant DuPont, which saw the privately held New Brighton, MN, company as an opportunity to deepen its expertise in the medical device market and health care industry.

When it became clear that an acquisition was on the horizon, Donatelle’s CEO Treasa Springett knew who to turn to: She called Fredrikson attorney Debra Linder, whom she had known for more than a decade. Donatelle had previously relied on the firm’s services in shareholder agreements for its multi-family member owners, estate planning and employment contracts. Now, to help with the complex sale transaction to a public company, Deb recommended enlisting Travis Anderson from the firm’s M&A group.

Deb served as a sounding board and guide through the complex change of control process for Donatelle’s key executives, while Travis and his team guided the company through every stage of the sale to DuPont, starting with identifying Donatelle’s equity purchase document, engaging with the financial advisor Piper Sandler, negotiating successive rounds of offers, and ironing out the details that led to the closing. Along the way, attorneys from Fredrikson’s Environmental Law Group were also called upon to resolve any issues associated with the company facility’s location on a Superfund site.

“I can’t say enough about my interactions with Deb and Travis every step of the way,” Springett said. “They always made us feel that we were their number one priority. I found the depth and breadth of capabilities and expertise across the firm to be phenomenal, allowing us to handle all the unexpected issues that emerged throughout this process. To me, that translates to high degree of confidence that I chose the right partner to work with.”

Following the acquisition by DuPont, Donatelle maintains its strong growth potential with its capability offerings and technical expertise supporting medical device manufacturing solutions targeting end markets in attractive therapeutic areas like electrophysiology, drug delivery, diagnostics, cardiac rhythm management, neurostimulation, and orthopedic extremities.