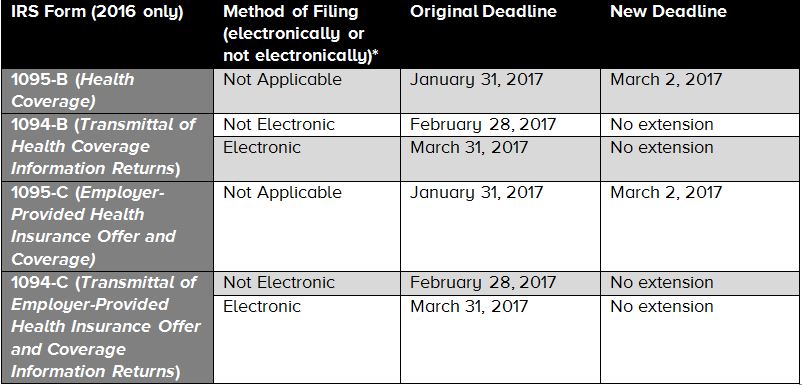

On November 18, 2016, the IRS released Notice 2016-70, which provides a partial extension of the deadlines for employer and insurer reporting under the Affordable Care Act. The standard deadlines have been delayed as follows:

* While only insurers and employers with more than 250 1095 statements are required to file 1094-B and 1094-C electronically, the IRS encourages all employers to do so.

For the 2016 reporting year, Notice 2016-70’s automatic extension of the 1095-B and 1095-C deadline eliminates the need to file for automatic extensions; however, employers or insurers may still apply for non-automatic extensions. For the 1094-B and 1094-C transmittals to the IRS, reporting parties may still request automatic or non-automatic extensions.

In addition, for the 2016 reporting year, the IRS has also extended relief from penalties if reporting entities can show that they made a good faith effort to comply with the reporting obligations. This relief only applies to incomplete or incorrect information on a statement or return, not a failure to file a statement or return at all.

Like last year, Notice 2016-70 includes relief for individuals who do not receive a 1095-B or 1095-C, as applicable, by the time they file their 2016 tax returns. These individuals may rely upon information from a health care exchange or their employer to determine whether they had minimum essential coverage or qualify for premium tax credits in 2016.

Please contact a member of Fredrikson & Byron’s Compensation Planning & Employee Benefits Group should you have any questions on how this guidance applies to your business or group health plans.