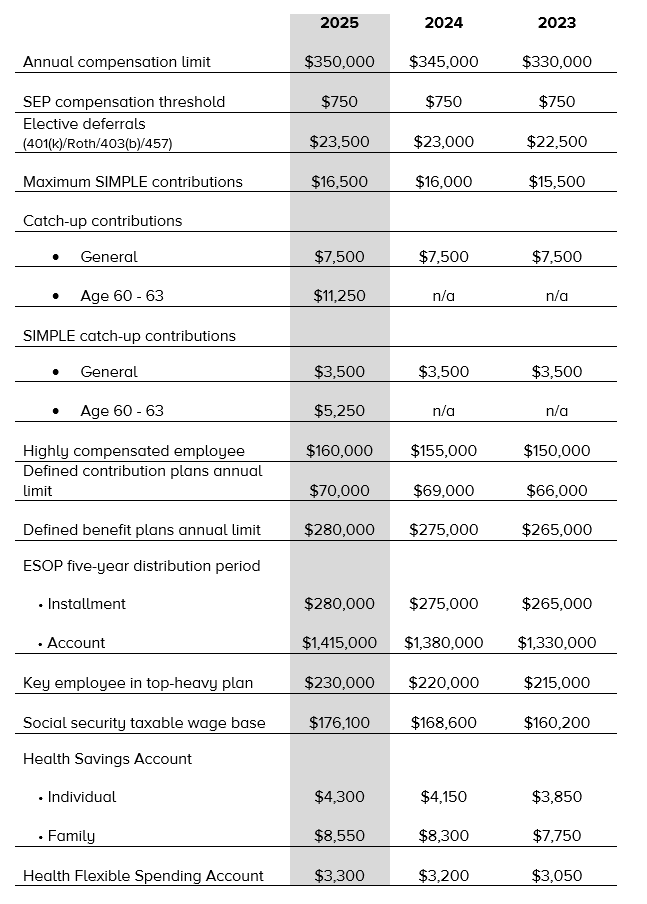

The Internal Revenue Service has announced the 2025 cost-of-living adjustments (COLAs) for benefit plans. They are as follows:

- Annual compensation limit. The compensation limit (IRC 401(a)(17)) applies for calculating benefits and contributions, for general and 401(k) discrimination testing and for determining tax deductions.

- Elective deferrals (401(k)/Roth/403(b)/457). The calendar year contribution limit applies to pre-tax and Roth salary deferrals.

- Catch-up contributions. The calendar year dollar limitation applies for catch-up elective deferral contributions for individuals who, in 2025, are age 50 or above. Effective in 2025, plan sponsors can add an optional “super” catch-up for employees reaching age 60-63 during the calendar year. The annual limit for this enhanced catch-up is $11,250 (instead of $7,500) for most deferred compensation plans and $5,250 (instead of $3,500) for SIMPLE IRAs.

- Highly compensated employee. A “highly compensated employee” is one who (a) was a more-than-5 percent owner during the year or the preceding year, or (b) for the preceding year (i) had compensation in excess of $160,000 and (ii) if the employer elects for the plan year, was in the top-paid group (top 20% of pay) of employees.

- Defined contribution plans annual limit. The annual dollar limitation on total additions (both deferrals and employer contributions) applies to defined contribution plans for plan limitation years ending in 2025.

- Defined benefit plans annual limit. For plan limitation years ending in 2025, the annual dollar benefit limitation under a defined benefit plan has increased to $280,000. For participants who separated from service before January 1, 2025, the 100 percent of average high-three-years’ compensation limit is computed by multiplying the participant’s compensation limitation, as adjusted through 2024, by 0262.

- ESOP five-year distribution period. The dollar amount used in determining the maximum account balance in an employee stock ownership plan subject to a five-year distribution period has increased to $1,415,000 in 2025, while the dollar amount used to determine the lengthening of the five-year distribution period is increased to $280,000.

- Key employee in top-heavy plan. In defining who is a key employee in a top-heavy plan, for plan years ending in 2025, the compensation threshold for an officer has increased to $230,000.

- Social security taxable wage base. The social security taxable wage base is the limit over which the retirement portion of FICA/FUTA taxes is not assessed (however, Medicare taxes are still collected).

For more information, contact your Fredrikson attorney.